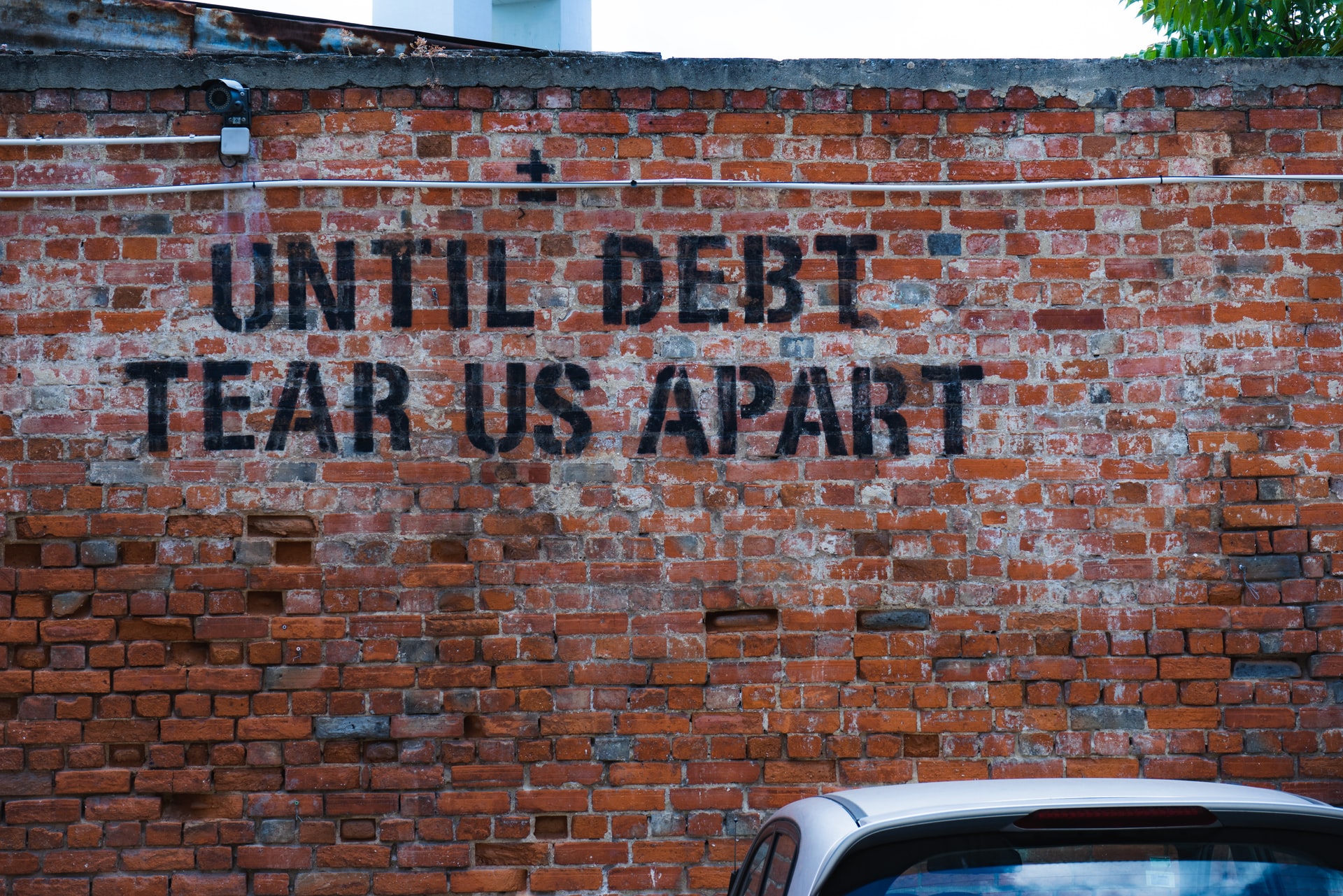

Debt has become a part of our lives. We need to incur debt to sustain or to achieve a better lifestyle. But, you need to manage it properly; otherwise, your debt will be out of control and you’ll have to face the consequences of not controlling your debt.

So, let’s find out how you’ll know that you’re in too much debt, and you need help.

You do not have clear knowledge about how much you owe

Are you scared to find out how much you owe? This is a sign that you have too much debt; that’s why you don’t want to face reality. However, how will you look for a suitable debt relief solution if you avoid reality?

Instead, accept that you’re in debt, sit with a pen and paper and list your debts so that you have a clear picture of how much you owe. While doing this, take into account both your secured and unsecured debts. It will help you to plan a strategy to repay your unsecured debts and be current on your secured debts as well.

You cannot make more than the minimum monthly payments

It is itself a red flag if you can’t make more than minimum monthly payments on your debts. Usually, when you make only the minimum payments, it mainly covers the interest payment. If there’s extra, the amount satisfies a portion of your debt. But, you can never be debt-free just by making the minimum payments every month. Your debt is growing every month. You’ll pay a lot more on interest in the long run.

So, if you’re making minimum monthly payments on your credit cards, select a suitable debt relief strategy and tackle your debts without wasting any more time. You need to tackle your debts head-on.

Your debt-to-income ratio is very high

If you calculate your debt-to-income ratio and find it is more, then be careful. You might have debt problems soon. It is a red flag if your back-end ratio is more than 43%. If you have more DTI, it might be a problem for you to take out a mortgage or an auto loan.

I would say that you should try to reduce your debt burden if it’s more than 20% of your monthly income.

You can’t disclose your financial reality to your partner

Have you recently started hiding your purchases from your partner? You’re always making stories so that your spouse doesn’t come to know about your financial reality.

Do you know that financial infidelity is also a major cause of divorce? So, be careful about it.

If you’re facing debt problems, talk to your partner, and together plan a suitable debt relief solution to find a way out.

Plan a budget with your partner to save a significant amount every month. Doing so, you can enjoy ‘we time’ too. You can use a budget excel template to plan a suitable budget.

You are requesting more credit limits to swipe for more

It may also happen that you’re asking to increase your credit limit so that you can meet your necessities thereby adding more to your credit card.

However, when you’re facing debt problems, a higher credit limit can help to lower your credit utilization ratio but don’t swipe your card for more. If required, for the time being, switch to cash purchase. It will help you reduce your expenses.

Your health is deteriorating due to financial stress

Certain debts like payday loans and high-interest credit cards are itself a stressful affair in your life. When you’re dealing with such debts, all the time you keep thinking of how to repay them. You can’t plan any strategy for a better financial future.

So, if required, take payday loan debt assistance and solve your debt problems with the help of a financial advisor. Otherwise, you might have to shell out more for medical treatment.

Moreover, don’t ruin your health for debt-related issues. Get rid of your debts and enjoy a stress-free life.

You are getting calls from debt collectors

It requires no mention that getting a call from a debt collector means that you have already defaulted on a loan. I will try to repay it asap.

If you’re getting a call to repay one debt, try to manage your other debts too. Too much debt means your credit score may also decrease. So, it’ll be a problem to take out a suitable loan at suitable terms and conditions in the future.

You have tried to repay the debt but haven’t been successful

Yes, if your debts are too high, you may not be able to solve your debt problems on your own. You may have to take some professional help to get rid of annoying debts.

So, if you’ve tried debt relief solutions but haven’t been successful, then take the help of others; but somehow solve your financial worries and live life stress-free.

Last but not least,

You are not able to save enough

Perhaps I should say, you’re not able to save at all. You’re living paycheck to paycheck life! You might also have taken out a payday loan or might have to if you face a financial emergency.

If you agree to this, your financial situation is not good. You will have to save more.

At least try to build an emergency fund along with paying back debts. Initially, deposit a small amount. Then, slowly increase it. Keep your target of having at least 3-6 months of your lifestyle expenses into that fund. Make sure, you don’t use that fund unless it’s a real emergency like a sudden car repair, medical emergency, and so on.

So, even if you have agreed to one of these sentences, it is a sign that your debt is out of control or going to be soon if you don’t tackle it properly. Try to follow the remedy that is discussed for specific red flags. 🙂

If required, you can approach a consolidation or settlement company for payday loan debt assistance or credit card help. You can also seek debt advice by participating in online forums.

When you post a query, the industry experts can provide you with possible solutions to overcome your debt problems.